At Sopher + Co, we can help you with tax, social security, payroll and permanent representation for remote workers.

The COVID-19 pandemic has brought about a significant shift in the way we work. With remote work becoming the norm, companies are now able to hire talent from anywhere in the world. This has led to the emergence of a new trend - the working from anywhere policy. While this policy has its benefits, it also poses some risks.

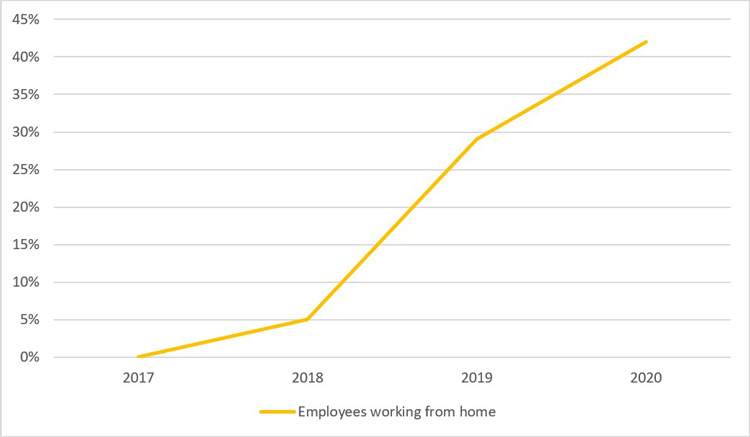

Dynamics of the number of employees who worked remotely

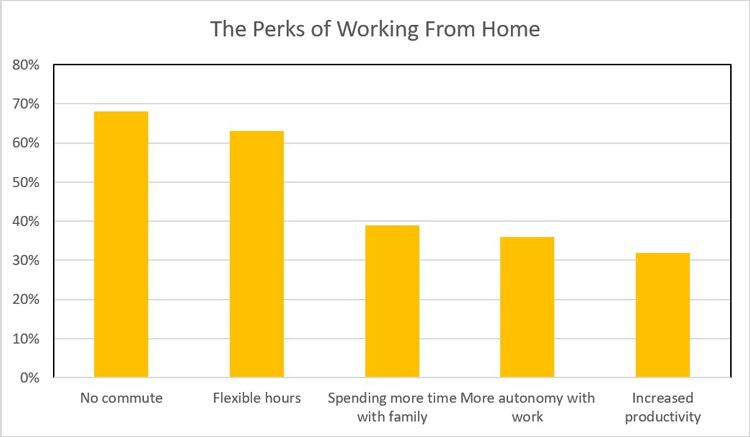

The perks of working from home

One of the main benefits of the working from anywhere policy is that it allows companies to tap into a global talent pool. This means that they can hire the best talent from anywhere in the world, regardless of their location, they can also retain valuable staff who now want to take advantage of a more flexible way of working for themselves and their families. This means that companies could possibly save on costs associated with relocation and office space. With remote work, employees can work from the comfort of their own homes, which can lead to increased productivity, mental health benefits and job satisfaction.

Source: YouGov

In addition to embracing the benefits of a working from anywhere policy, there are also tax, social security, payroll, and permanent establishment issues that companies need to consider.

Tax laws

One of the main tax issues is determining which country's income tax laws apply to remote workers and their remuneration. This can be a complex issue, as different countries have different tax laws and regulations. Companies need to ensure that they are complying with the tax laws of the countries in which their remote workers are located. Social security is another issue that companies need to consider. In some cases, remote workers may be subject to social security taxes in both their home country and the country in which they are working. The rules for social security do not always follow the rules for income tax and employers need to ensure that they are complying with the social security laws of both countries to avoid any legal issues. Where tax and social security are an issue the compliance obligations of providing a local payroll should also be considered. Employers should ensure that they are paying their remote workers in compliance with the laws of the country in which they are working. Different countries have different payroll laws, regulations, registration requirements and each one should be reviewed separately.

Permanent establishment (PE)

Another issue that companies need to consider when implementing a working from anywhere policy is permanent establishment (PE) issues. PE is a concept in international tax law that determines whether a company has a taxable presence in a foreign country. If a company has a PE in a foreign country, it may be subject to tax in that country. With remote workers, companies may inadvertently create a PE in a foreign country if their remote workers are working from that country for an extended period of time. This can happen even if the company does not have a physical presence in that country. For example, if a company has a remote worker in France who is working from home for an extended period of time, the company may be deemed to have a PE in France.

Companies need to be aware of the PE rules in the countries in which their remote workers are located. They may need to register for tax purposes in those countries and comply with local tax laws. Failure to comply with the PE rules can result in penalties and legal issues.

In conclusion, the working from anywhere policy has it benefits and the potential to revolutionise the way we work. Employers should engage with their advisers and be aware of the tax, social security, payroll, and permanent establishment issues that come with it. Companies that take the time to understand and comply with the laws and regulations of the countries in which their remote workers are located are likely to avoid legal issues and reputational issues that come with getting it wrong and thrive in the new world of work.

If you would like advice on tax issues relating to remote workers, please contact Sopher + Co.